CRM Essentials

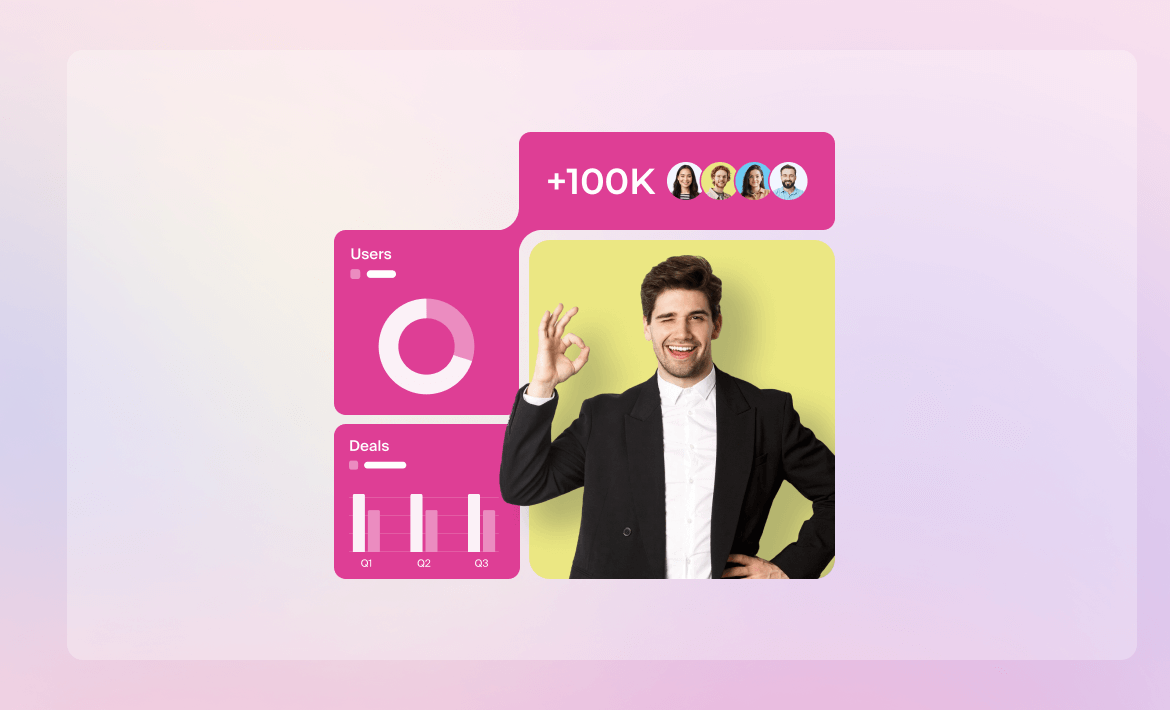

Lead management CRM: How NetHunt CRM helps you capture and nurture leads effectively

Product

Lead generation

Get leads from various sources

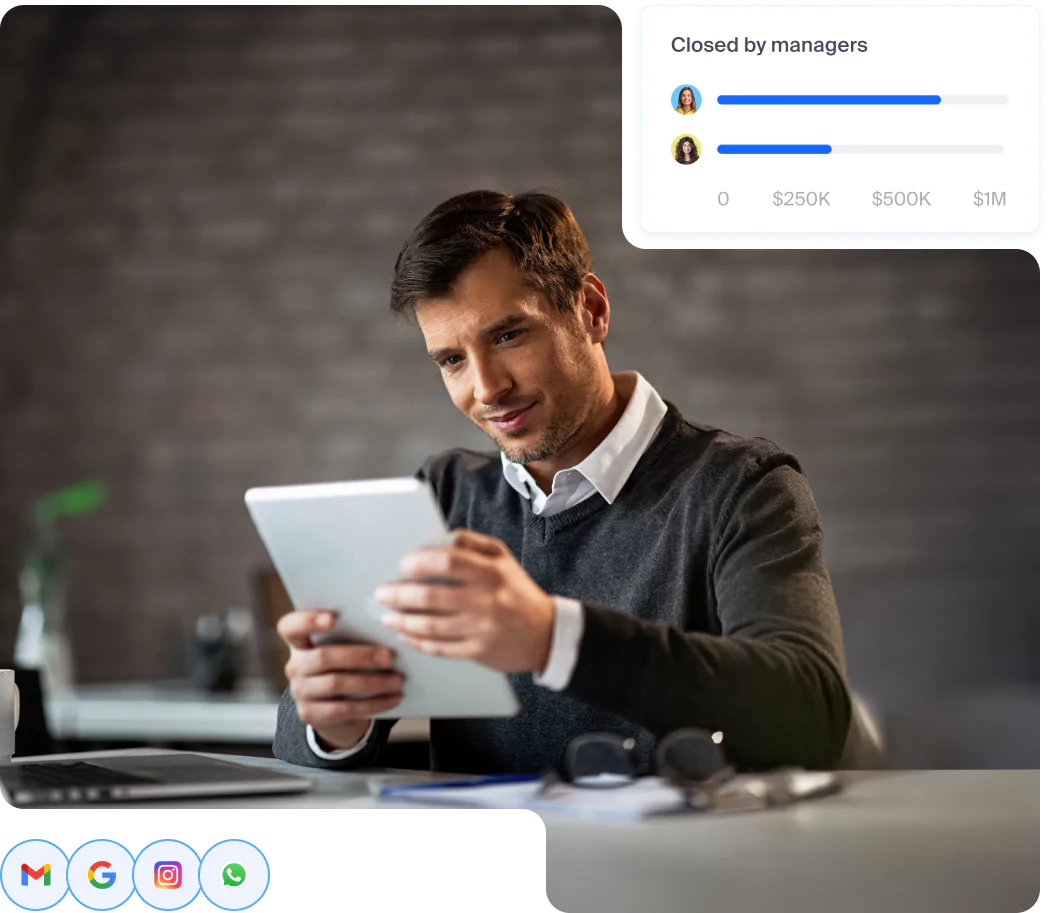

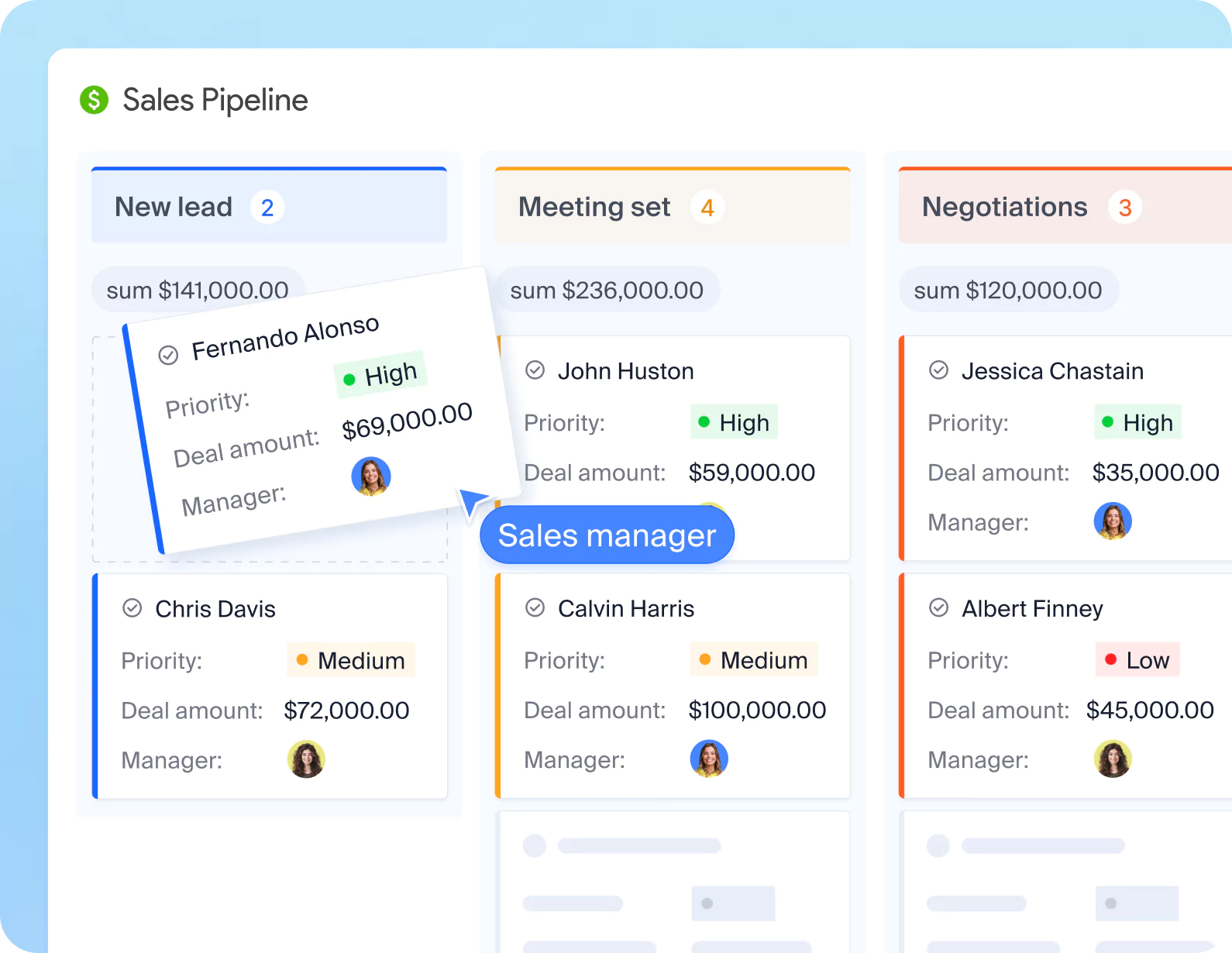

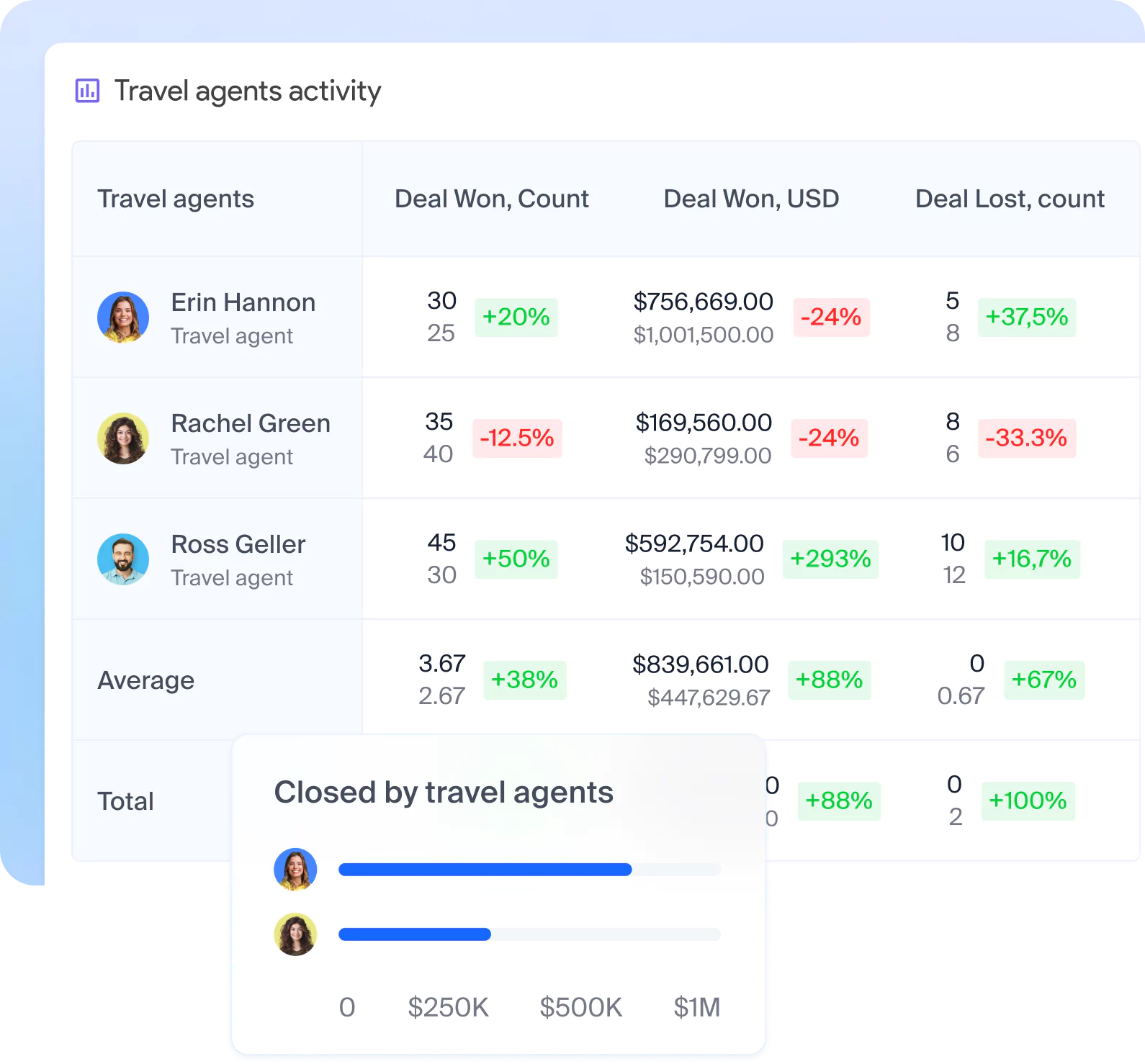

Sales management

Deals, teams, revenue — covered

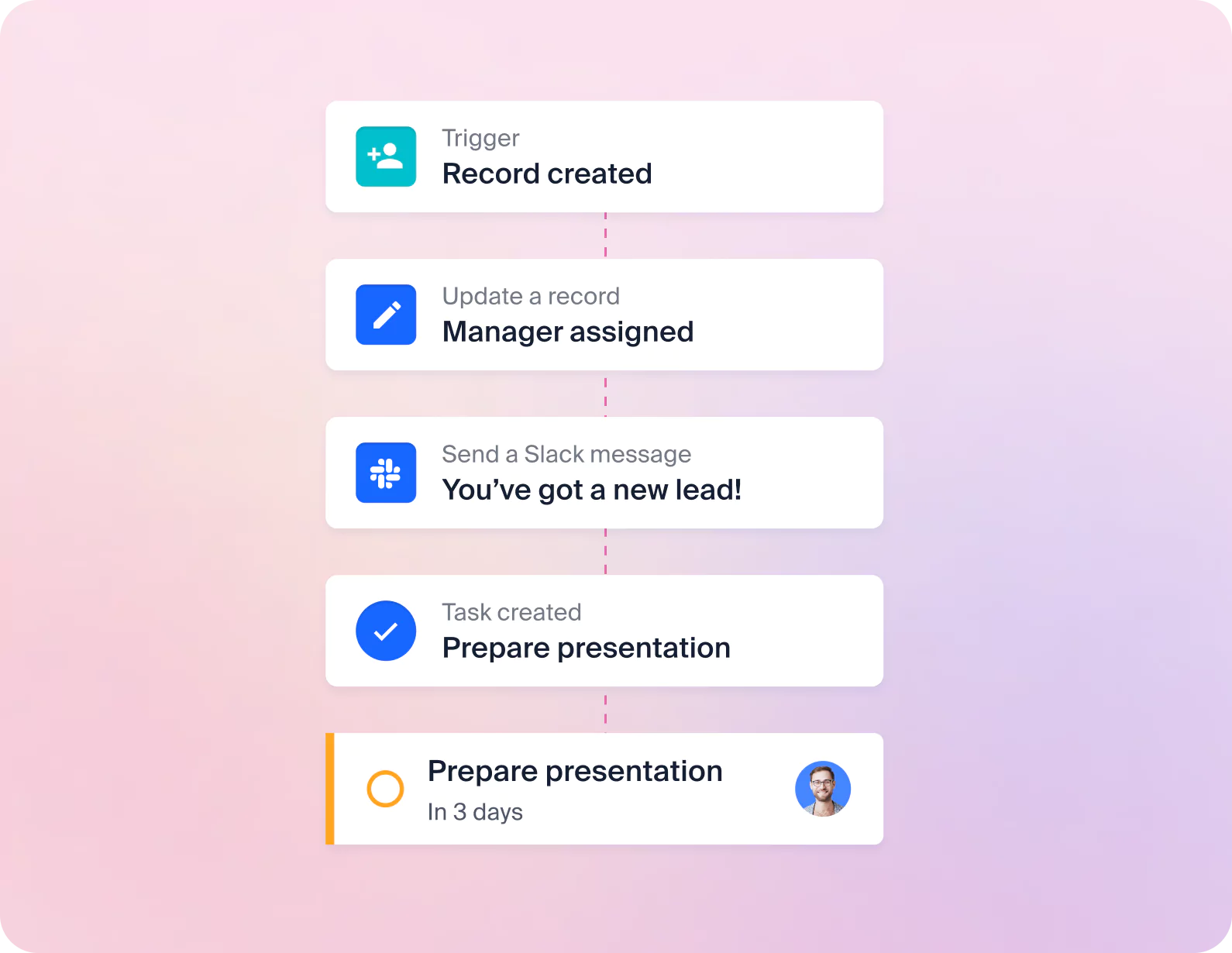

Sales automation

If-this-then-that, no code needed

Integrations

Sync everything with your stack

- Sales pipeline Visualize and own every stage of the deal

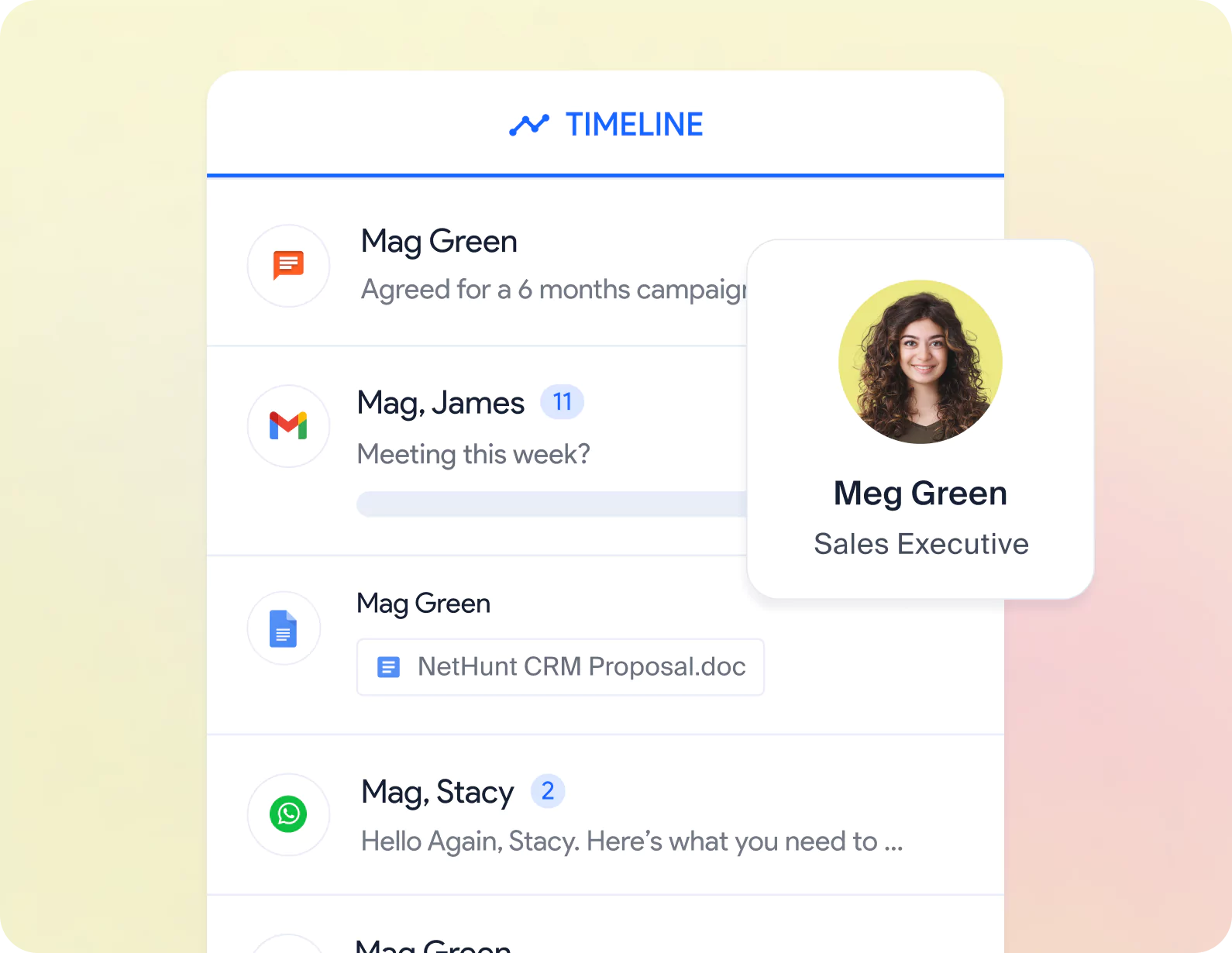

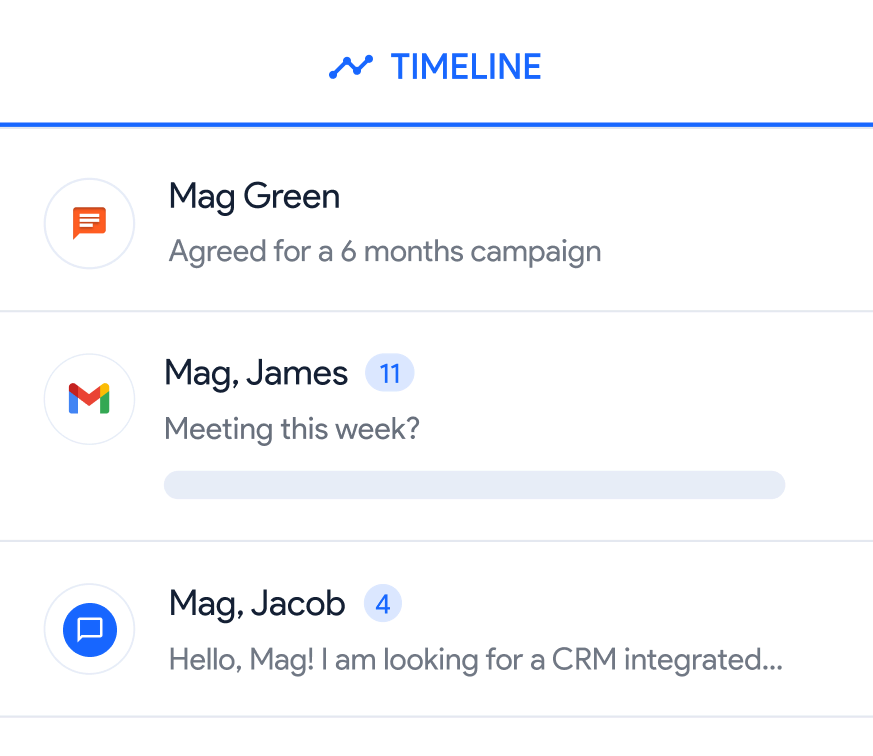

- Contacts Know who’s who — and what’s next

- Leads Full control and insight into every lead

- Reports Keep your team aligned and accountable

- Team Keep your team aligned and accountable

Why us?

Customer stories

Customer wins, powered by NetHunt

Comparison

See how NetHunt CRM stands out

By roles

CRM tailored to how you work

By industry

Powering teams across industries

Resources

Product help

Your go-to hub for product how-tos

Content hub

Smart content to grow and win

Guide

Multi-channel

sales framework

product experts — let's find the best setup for your team

product experts — let's find the best setup for your team