The sound of a successful quarter; the satisfaction of seeing your company's revenue grow. For executives, it's the result of strategic decisions, leadership, and ensuring that every department aligns with the company's overarching objectives.

Central to this success is the sales team, and behind their achievements lies a meticulously designed sales compensation plan. This plan is not just about rewarding salespeople; it's about driving the right behaviours, aligning with corporate goals, and ensuring sustainable growth.

Understanding and optimising sales compensation is crucial for any executive aiming to lead a thriving organisation. Join us as we delve into the nuances of sales commission structures, exploring how to craft a plan that not only motivates your sales force but resonates with your company's broader vision.

Let's strategise for success together!

What is sales compensation?

In simple terms, sales compensation is the total package of rewards that salespeople receive, and it's not just about the salary. A blend of base salary, commissions, and extra incentives is what makes hitting those sales targets even more enticing.

The main aim is to get sales reps fired up to meet and, even better, smash those sales targets. All while ensuring their goals are dancing in tune with the grand symphony of the company's broader objectives.

Key components of sales compensation

Before diving deep into the world of sales compensation, it's essential to get familiar with the core components. Think of these as the building blocks that make up the entire sales compensation structure…

- Base salary is the fixed amount paid to sales reps, regardless of their sales performance. It's the steady beat that keeps things going in our musical analogy.

- The commission is the variable part of the compensation, directly tied to the sales made. The more you sell, the more you earn. It's the exciting crescendo.

- Bonuses are the additional rewards for achieving specific milestones or targets. They are the surprise solos that make the sales process that much better.

- Sales accelerators are extra incentives for those who go above and beyond, surpassing their sales quotas; the standing ovation..

- Sales decelerators are the opposite of accelerators. These are reductions or penalties for those who might miss a beat and not meet their quotas. A bum note.

- On-target earnings (OTE)x are the total expected compensation, combining both the base salary and potential commissions. The grand finale shows what's possible when everything comes together.

What kinds of sales compensation structures exist?

Sales compensation structures are the backbone of a motivated sales team. They not only incentivise performance but shape the sales culture of an organisation. Let's delve deeper into the various compensation models, understanding their nuances and weighing their advantages and disadvantages.

Salary only

This sales compensation model provides sales representatives with a consistent, fixed salary, irrespective of their sales achievements. It's a straightforward approach, ensuring that every salesperson knows exactly what they'll earn at the end of the month.

Pros

Cons

Provides financial stability and predictability for salespeople.

May not adequately incentivise high performance.

Simplifies payroll and budgeting processes.

Leads to complacency and a lack of drive to exceed.

Reduces pressure on salespeople, allowing them to focus on building long-term relationships.

Might not be cost-effective if sales targets aren't met.

Attracts talent seeking job security.

Doesn't directly tie earnings to individual performance.

So in this model, a salesperson would earn a base salary of, say, $4,000USD per month, which would be the only kind of compensation they would receive.

Commission only

Here, salespeople's earnings are directly tied to their sales achievements. They earn a predetermined percentage of the sum of their closed deals during a certain period, theoretically making their potential earnings limitless.

Pros

Cons

Directly ties earnings to performance, offering potentially higher rewards.

Can be financially unstable for salespeople during quieter times.

Reduces financial risk for the company during low sales periods.

Might encourage aggressive or short-term sales tactics.

Can lead to increased sales activity and drive.

Can lead to high staff turnover if consistent sales aren't achieved.

Encourages a proactive approach to sales.

May cause undue stress or pressure on sales staff.

In this model, a salesperson makes a percentage of the sales he achieved during the month. For example, if a salesperson gets a 10% commission on his sales, and he manages to sell $1,000 worth of his company's product, he will make $100 off those sales.

Salary + commission

This is a balanced approach where sales representatives receive a guaranteed base salary, complemented by a commission based on their individual sales performance. It offers the best of both worlds, combining stability with performance-based incentives.

Pros

Cons

Provides a stable income with the potential for higher earnings.

Can be more complex to administer and track.

Encourages consistent sales efforts without neglecting customer relationships.

Requires careful balancing to ensure neither component overshadows the other.

Offers a safety net during slower sales periods.

Might lead to disputes or confusion over commission calculations.

Can attract a broader range of sales talent.

Can be costlier for the company if base salaries are high.

In this model, the salesperson gets a base salary plus a percentage of the sales they close.

Tiered commission

This dynamic model sets commission rates based on predefined sales thresholds or tiers. As salespeople achieve and climb the tiers, they enjoy progressively higher commission rates, making every sale count.

Pros

Cons

Motivates salespeople to continuously aim higher.

Can be complex to set up and explain to the sales team.

Rewards top performers with progressively higher earnings.

Can demotivate those struggling to reach the first tier.

Offers clear milestones and goals for salespeople.

Requires regular monitoring and adjustments.

Leads to rapid revenue growth for the company.

Can lead to aggressive competition among sales staff.

For example, a tiered structure could look like this…

- 5% commission on deals under $10,000

- 10% on deals between$10,000 and $20,000

- 15% on deals over $20,000

Or like this…

- 5% commission on the first 5 sales of the month

- 10% commission on the next 5 up to 10

- 15% commission after 10 and above

Draw against commission

In this sales compensation model, sales representatives receive an advance or "draw" against their future commissions. This draw is then reconciled against actual commissions earned, ensuring a steady income stream. This essentially means borrowing your paycheck against your potential to bring revenue to the business.

Pros

Cons

Provides financial stability during slow sales periods.

This can lead to debt accumulation if consistent sales aren't achieved.

Ensures a consistent income, reducing financial stress for salespeople.

Might discourage salespeople if they consistently owe back their draw.

Can motivate salespeople to cover their draw quickly.

Requires meticulous tracking and reconciliation.

Offers a safety net, especially for new salespeople.

Can be complex to explain and administer.

In this model, a salesperson “borrows” their salary against the amount they’re expected to make this month. For example, a salesperson will be paid $4,000, but expected to make that in sales throughout the month. If they end up making less than $4,000 in sales, they are in debt with their employer.

Profit sharing

This model works by splitting a percentage of the total profits amongst all salespeople. It rewards salespeople based on the company’s overall profitability rather than individual sales, fostering a sense of collective responsibility and aligning the sales team's efforts with the broader financial health of the company.

Pros

Cons

Aligns the sales team’s efforts with the company’s financial success.

Might demotivate employees if profits decline due to factors beyond their control.

Encourages a broader view of company performance, not just individual sales.

Requires transparent communication about company finances.

Fosters a sense of collective responsibility and teamwork.

Can be complex to calculate and distribute.

Leads to a more unified company culture.

Might lead to disputes if not structured transparently.

For example, your business makes a total of $90,000 in monthly profits. A percentage of that $90,000 (anything outside accounting for growth) is shared between the salespeople; a very popular compensation model in the world of finance.

Performance-based bonus

This model rewards salespeople for achieving specific targets beyond their regular compensation. It can be tailored to individual or team achievements, offering additional motivation to exceed set targets.

Pros

Cons

Offers additional motivation to exceed set targets.

Might lead to competition and reduced teamwork, if not structured correctly.

Can be tailored to individual or team achievements.

Requires clear communication about bonus criteria.

Provides a clear roadmap for salespeople to earn extra.

Can be complex to track and administer.

Encourages going the extra mile.

Might lead to disputes if bonus criteria aren't met.

In this model, a salesperson is paid an extra bonus when they exceed their monthly targets. For example…

- 5% salary bonus if the salesperson manages to exceed ten successful sales.

Or…

- A $300 bonus for every sale above $30,000 in value.

Residual income

Sales representatives earn recurring commissions from ongoing customer relationships, such as recurring subscriptions or service contracts. It rewards maintenance and nurturing of long-term customer relationships.

Pros

Cons

Provides a steady, recurring income stream.

Can be impacted by customer churn or contract cancellations.

Encourages long-term customer relationships and retention.

Might discourage seeking new clients if residuals are too comfortable.

Rewards the maintenance and nurturing of existing accounts.

Requires tracking and management of ongoing contracts.

Can lead to more predictable revenue streams for the company.

Can be complex to calculate and administer.

Rather than just earning a commission on the initial sale, the salesperson receives a commission every time their customer conducts additional business with the company.

Territory-based compensation

Sales representatives are compensated based on the profitability of their assigned territory. It encourages comprehensive territory management and rewards nurturing local relationships and networks.

Pros

Cons

Encourages comprehensive territory management.

Might lead to disputes over territory assignments.

Simplifies compensation calculations based on territory performance.

Impacted by external factors in a specific territory.

Rewards the nurturing of local relationships and networks.

Requires tracking and management of territory performance.

Leads to more focused sales strategies.

Might discourage cross-territory collaboration.

Navigating sales compensation: Step-by-step guide from structure to calculation

Navigating sales compensation requires a delicate balance of aligning individual and organisational goals. From setting clear quotas to calculating precise commissions, each step must be carefully considered to motivate and reward your sales team.

In this step-by-step guide, we'll explore how to structure and calculate sales compensation, with insights into leveraging tools like NetHunt CRM to streamline the process.

Step 1: Set clear sales quotas

Sales quotas are revenue targets set for salespeople, either individually or as a group. These can be monthly, quarterly, or annually. Ensure that sales quotas are clear, achievable, and aligned with the company's objectives.

Here are some tips to consider when setting sales quotas…

- Analyse past sales data to understand trends and set achievable targets. This provides a realistic benchmark for future performance.

- Consider current market conditions and industry trends. If the market is booming, quotas might be set higher. If there's an industry-wide slump, it's essential to adjust expectations accordingly.

- If your company is launching a new product or service, anticipate the initial buzz and adjust quotas to reflect potential increased sales.

- Engage with your sales team. Their feedback can provide insights into potential challenges or opportunities in the market.

- Sales quotas shouldn't be static. Regularly review and adjust them based on changing conditions and new data.

Step 2: Make sure that the roles team structure is established and clarified

It’s obvious that salespeople taking up higher roles within the company hierarchy need to be paid more due to having a higher impact on the business operations. Still, figuring out the seniority of roles in the sales department can sometimes be tricky. Other than team leads and department heads, most companies tend to structure their roles based on experience with the levels being…

- Entry-level junior positions

- Mid-level positions

- Senior positions

After that, salespeople move up to the next position in the company.

For example, a Senior Sales Development Representative (Sr. SDR) might progress to Junior Account Executive (Jr. AE). However, at the end of the day, your role structure is yours to design.

If you’re feeling inspired by the three-tiered structure we provided above, here’s another little cheat sheet on how it works…

Role

Description and industry experience needed

Junior Sales Development Representative (Jr. SDR)

Entry level position, takes care of smaller-scale sales, such as sales to small clients, no experience needed. Their tasks include lead generation, cold outreach, follow-up management, and data entry.

SDR

Requires a year or more of experience; mostly works with mid-level deals. Their responsibilities include lead qualification, appointment setting, and continuation of outreach once the prospect initially replies.

Sr. SDR

Focuses on bigger deals, doesn’t require experience per se, but is based on merit earned during the SDR stage. Their responsibilities include overseeing lead generation/qualification, mentoring Jr. SDRs, developing outreach strategies, performance analysis, and handling bigger, more complex deals.

Jr. Account Executive (AE)

Requires one to two years of experience; works on smaller accounts. Junior AEs don’t usually stick to an account. Instead, they take the account through onboarding and pass it on to their higher ranked colleagues. Jr. AE responsibilities include client onboarding, relationship building, sales presentations, and product technical support

AE

Requires two or more years of experience; works on medium-scale deals. AE’s responsibilities include client management, performance tracking, upselling/cross-selling, strategic sales closure for medium-sized deals

Senior Account Executive (Sr. AE)

Focuses on larger deals; requires three or four years of experience. Sr. AE usually takes care of key accounts of the business, making sure the most important clients are satisfied. Their responsibilities include sales leadership (coaching and mentoring Jr. AEs and AEs), developing long-term strategies and goals, building relationships with key accounts, managing enterprise clients, and onboarding and implementing solutions for enterprise clients

Jr. Customer Success Manager (Jr. CSM)

Responsible for client onboarding; requires no experience. Their duties usually include customer onboarding (if not done by Jr. AEs) and customer support

CSM

Helps clients renew the product and takes care of upsells. Requires up to a year of experience. Usually, CSM tasks involve client retention, relationship building with clients, customer support, and andling renewals and upsells for non-key accounts.

Sr. CSM

Responsible for helping, handling renewals and upselling key accounts, requiring around three years of experience. Sr. CSM tasks involve handling renewals and upsells for key accounts, guiding and mentoring more junior colleagues, and developing long-term strategies for the rest of the team to adapt.

Step 3: Calculate the commission amount

Once you have the sales figures and the commission rate structure you want to use, you can calculate the commission amount. Multiply the total sales by the commission rate to get the commission amount. You can generate the total sales report with the help of your CRM system.

For instance, if a salesperson sells $10,000 worth of products and the commission rate is 10%, the commission is $1,000.

For tiered commission structures, the rate might change as sales reach certain thresholds. An example of a tiered commission structure would look like this:

Tier

Total Sales Made ($)

Commission %

1

$5,000

5%

2

$5,001-10,000

7%

2

$10,000+

10%

Sometimes returns, discounts, or allowances need to be deducted from the sales amount before calculating the commission. For example, if the total sales are $10,000, but there were $1,000 in returns, then the commission is calculated as a percentage of $9,000.

Another important part of calculating your sales commissions is checking against the industry standard to make sure you’re not underpaying your employees. A great place to start when checking industry-standard commissions are websites like GlassDoor or looking at salary reports for the current year in your geographical area.

A CRM system helps businesses calculate their commission by having real-time, organised, and automatically collected data available at the click of a button. If you're regularly calculating commission, consider investing in a CRM like NetHunt CRM.

Step 4: Decide on the compensation strategy

Once you’ve set your quotas, defined your roles, and calculated your commission amounts, it’s time to decide which strategy you’re going to implement.

Which strategy you use depends heavily on factors such as industry, geographical location, and your company's values. We’ve outlined a few examples of how different industries handle their compensation structures for some inspiration below.

Industry

Preferred structure

Technology

Base salary + commission

Finance

Profit sharing

Car sales

Commission only

Step 5: Consider additional incentives

Some organisations offer sales accelerators which kick in when salespeople exceed their quotas. Conversely, sales decelerators may apply if salespeople underperform. Your business needs to understand any additional incentives or penalties that might affect the final commission amount.

Here are some common ways that businesses provide additional incentives to their salespeople…

- Extra cash rewards for top performers or those who exceed their sales quotas.

- Increased commission rates once salespeople surpass a certain threshold.

- One-time bonuses for landing significant clients or contracts.

- Additional rewards at the end of the fiscal year, often tied to annual performance or company profitability.

- Short-term incentives to push specific products or achieve quick sales goals.

- Trips, gadgets, event tickets, or other perks for outstanding sales achievements.

Step 5: Account for clawbacks

Clawbacks are provisions where a salesperson might have to return their commission if a customer churns within a specific period. Ensure that any clawbacks are accounted for in the final compensation calculation.

Understanding the conditions which invoke a clawback is crucial. This ensures transparency and avoids potential disputes. While they might seem punitive, clawbacks are designed to align the salesperson's interests with the company's long-term success and its relationships with clients.

Step 6: Break the news to your sales team

After implementing a new compensation plan, keeping your salespeople in the loop is incredibly important. Not setting out the plan with clarity can have negative consequences.

Salespeople need chance to adapt to and get a feel for the new compensation structure before it’s implemented fully. Having a roll-out plan also allows you to tweak your sales compensation strategy before it’s applied to the entire team.

Step 7: Regularly review and adjust

In sales, it's essential to keep a pulse on the effectiveness of your commission structure. Regular reviews ensure that your compensation plan remains competitive, motivating, and aligned with the company's objectives.

Here are some pointers to consider during the review…

- Analyse the performance metrics of your sales team. Are they meeting quotas? If not, is the commission structure a factor?

- Engage your sales team to gather feedback. They can provide valuable insights into what's working and what's not in the current structure.

- Stay updated with market trends and industry benchmarks. Adjust your commission structure if it's falling behind or becoming too generous compared to the industry average.

- Ensure that the commission payouts are sustainable and don't strain the company's finances.

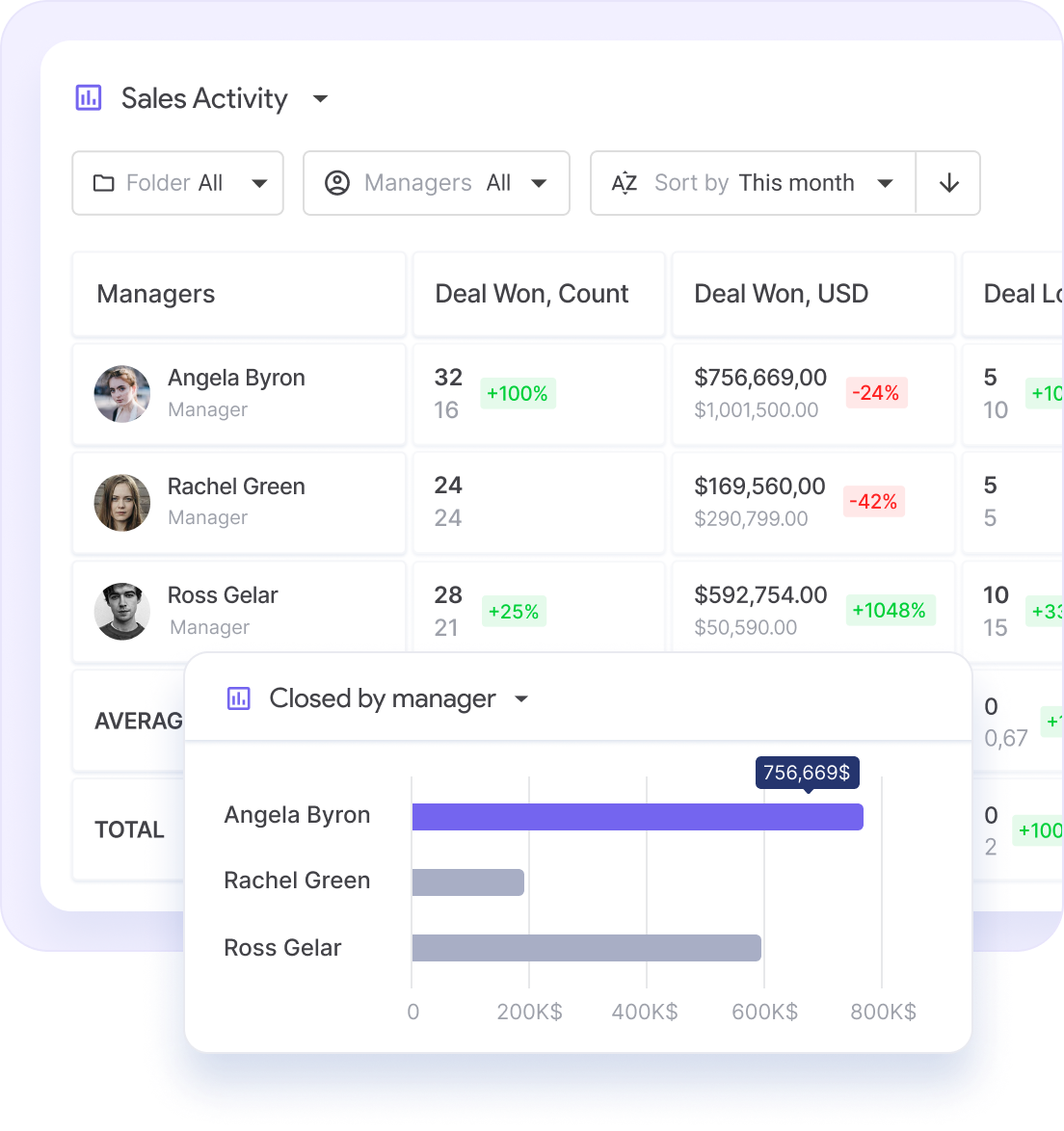

Harnessing NetHunt CRM for compensation reviews

NetHunt CRM's robust reporting functionality is just the thing for businesses aiming to fine-tune their sales compensation structures.

With features like the "Sales Pipeline Report" and "Sales by Owner Report," companies can gain deep insights into sales performance, deal values, and individual contributions.

This data-driven approach provides informed decisions, ensuring the commission structure remains competitive and sustainable. Moreover, the "Lost Reason Report" sheds light on potential areas of improvement, guiding adjustments to the compensation plan.

NetHunt CRM empowers businesses to align compensation structures with real-time performance and market dynamics.

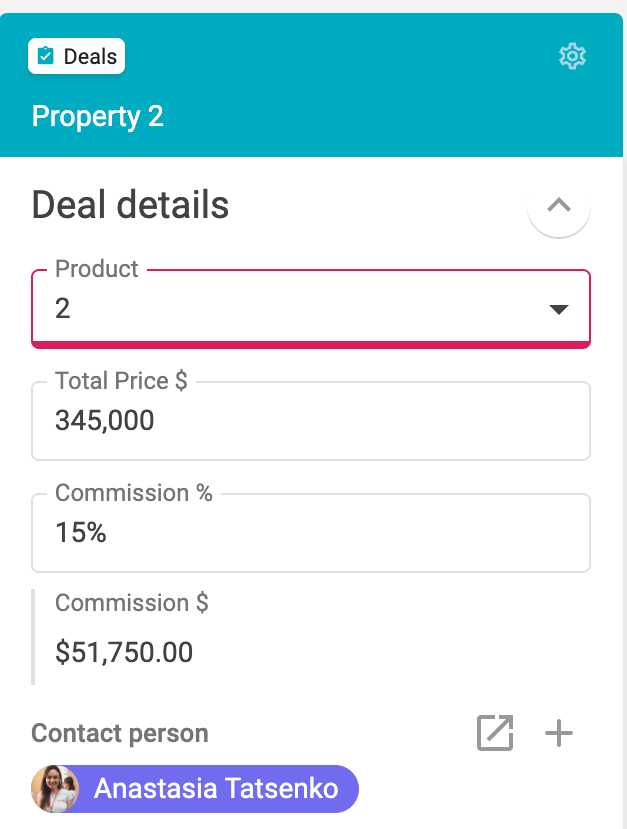

By utilising NetHunt CRM’s formula fields, you’re also able to automatically calculate commissions.

For example, if the salesperson enters the deal value as $10,000, and their commission is 10%, the “commission” field is automatically set to $1,000. If the value of the deal changes – the formula field will change as well to reflect the change.

Sales compensation plan examples

Once you’ve collected all your information and are ready to create a sales compensation plan, it’s time to compile it in an easy-to-read way.

Here are a few examples of how you could structure your compensation plans…

SDR compensation plan

SDRs are primarily responsible for outbound prospecting activities like cold calls, cold emails, and follow-ups. Their main goal is to generate potential leads and pass them to account executives for closure.

Compensation Plan Breakdown

- Duty: Generating qualified sales leads (QSLs).

- Metrics/ targets: Total number of QSLs.

- Projected earnings: $68,000 annually [Base: $48,000 + Commission: $20,000].

- Sales objective: 12 QSLs each month.

Given a 70:30 split between base salary and commission, an SDR would earn approximately $4,000 as a fixed monthly salary, with an additional potential commission of $1,666 based on performance.

Scenarios…

- Achieving targets: The SDR generates 12 QSLs in a month, meeting 100% of their sales goal.

- Underperformance: The commission decreases proportionally if the target isn't met.

- Exceeding targets: The commission increases proportionally based on overachievement.

AE compensation plan

AEs have a more comprehensive role than SDRs. They not only find new opportunities but are also responsible for closing deals initiated by SDRs. Their compensation can include additional bonuses for achieving specific milestones.

Compensation plan breakdown…

- Duty: Contributing to revenue.

- Metrics/ targets: Revenue generation.

- Projected earnings: $95,000 annually [Base: $66,500 + Commission: $28,500].

- Sales objective: $20K Monthly Recurring Revenue (MRR).

With a 70:30 ratio between base and commission, an AE would earn roughly $5,500 as a fixed monthly salary, with an additional potential commission of $2,375 based on sales performance.

Scenarios…

- Achieving targets: The AE achieves the set MRR for the month.

- Underperformance: The commission decreases proportionally if the MRR target isn't met.

- Exceeding targets: The commission increases proportionally based on overachievement.

The bottom line

And there you have it — the art and science of sales compensation, demystified. Crafting the perfect compensation plan is much like composing a hit song; it requires the right balance of rhythm, harmony, and passion.

A well-structured compensation plan not only rewards your sales team but also propels your business towards its crescendo of success. With tools like NetHunt CRM, you're equipped to fine-tune your strategy, ensuring every member of your team feels valued and motivated.

So, as the curtain falls on our deep dive into sales commission, we leave you with this thought: Let's make every payday a standing ovation for your sales team's stellar performance. Here's to hitting all the right notes in your sales journey!

Table of Contents

Crack the sales formula with CRM Lab

Twice a month, receive actionable CRM content to your inbox.