Work from the comfort

of your Google Workspace

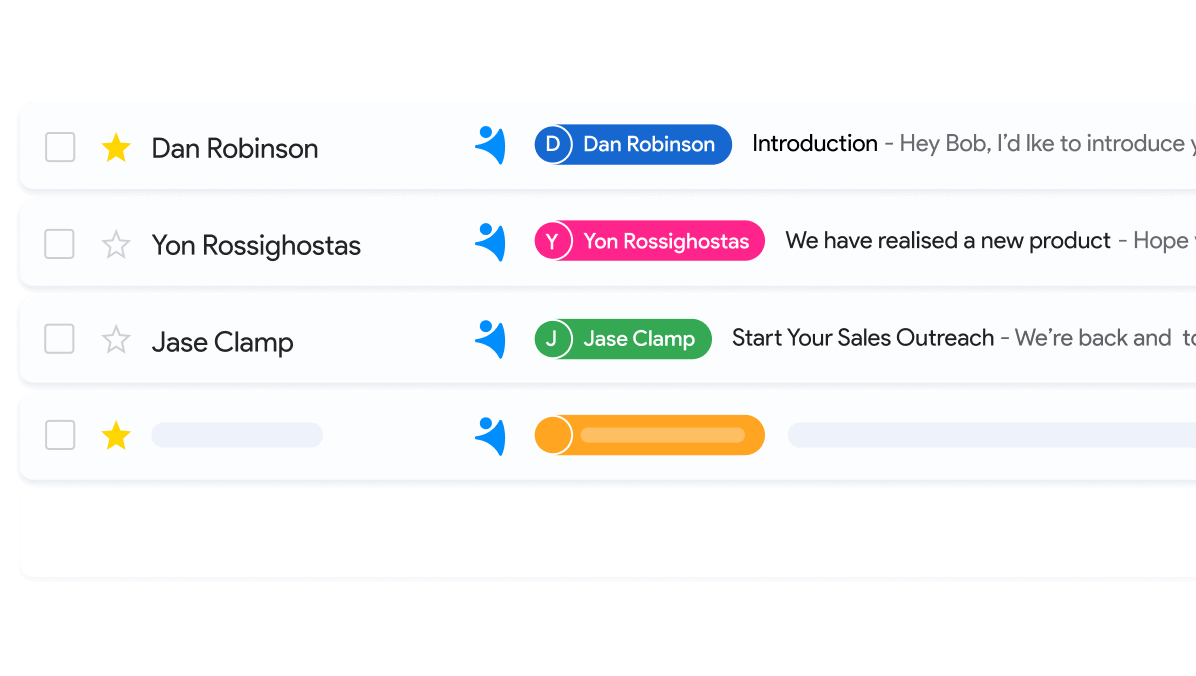

Automatically update records based on your Gmail communications.

Get your Contacts automatically added and updated in CRM.

Get access to client details directly from Calendar events.

Link files that you send to customers to their CRM records – never miss a detail.

Pull CRM data to Looker Studio to build real-time reports that unite data from various sources.

Organize your data

NetHunt automatically structures and streamlines business data effectively and productively.

Organize your customer base and work with it efficiently

- no more adding new contacts manually;

- no more cleaning up duplicate contacts;

- no more reminding the team to fill in all details.

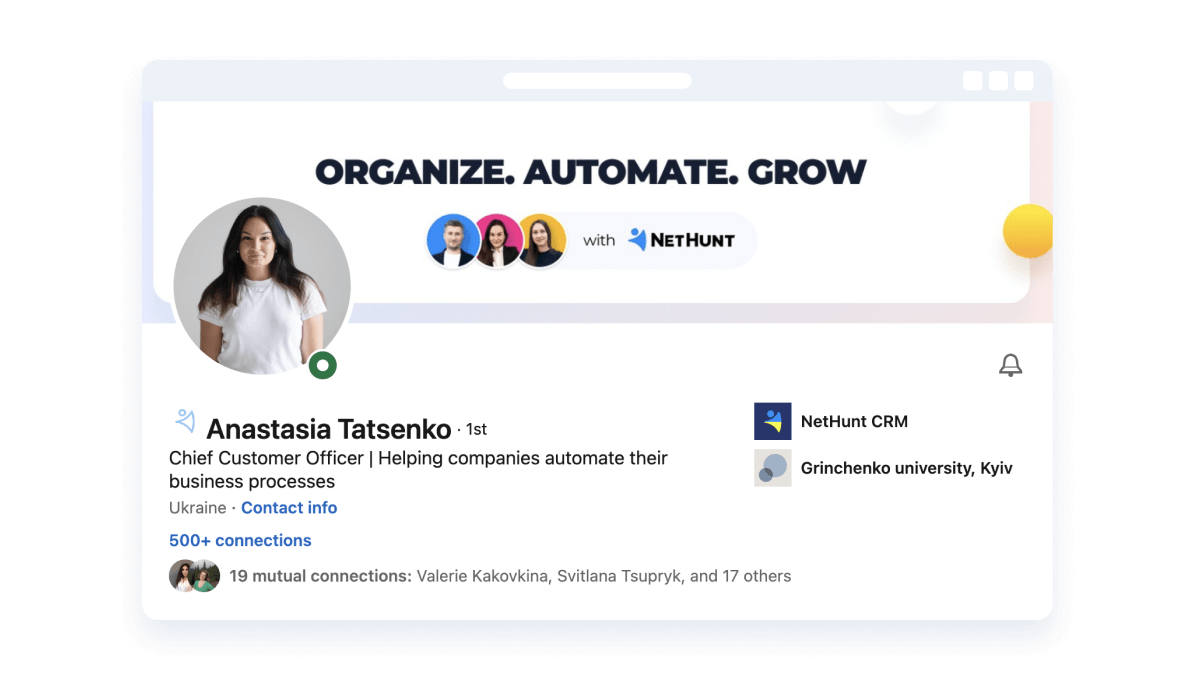

Automate lead generation processes and act on new opportunities fast

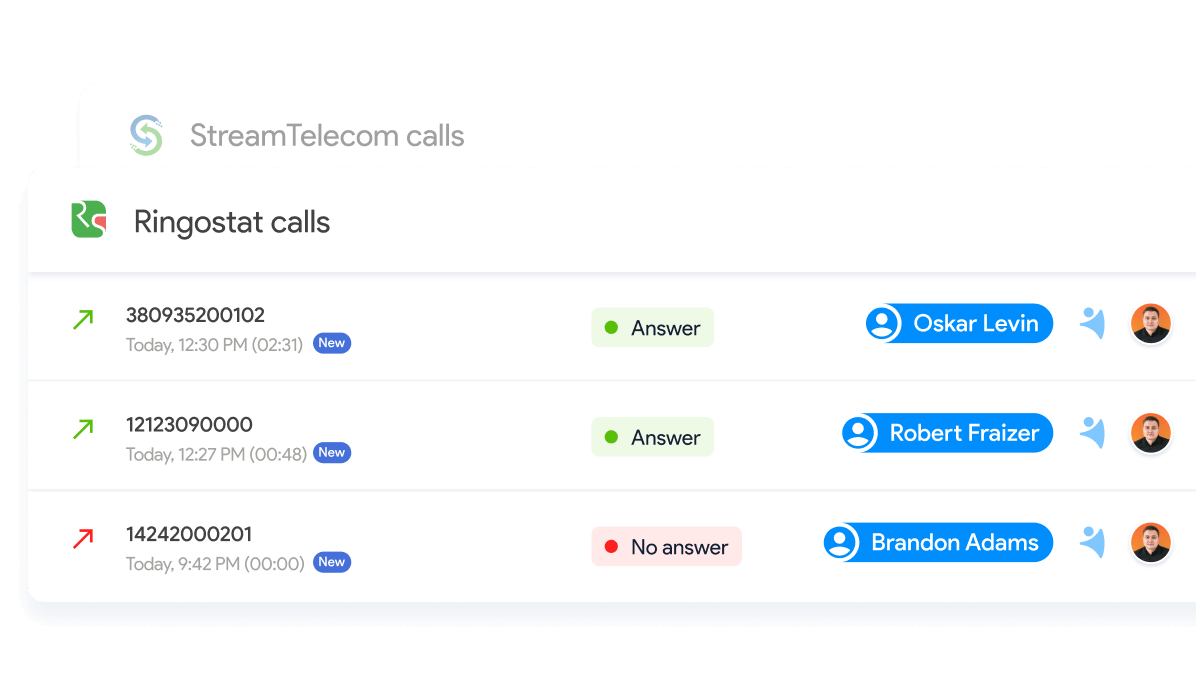

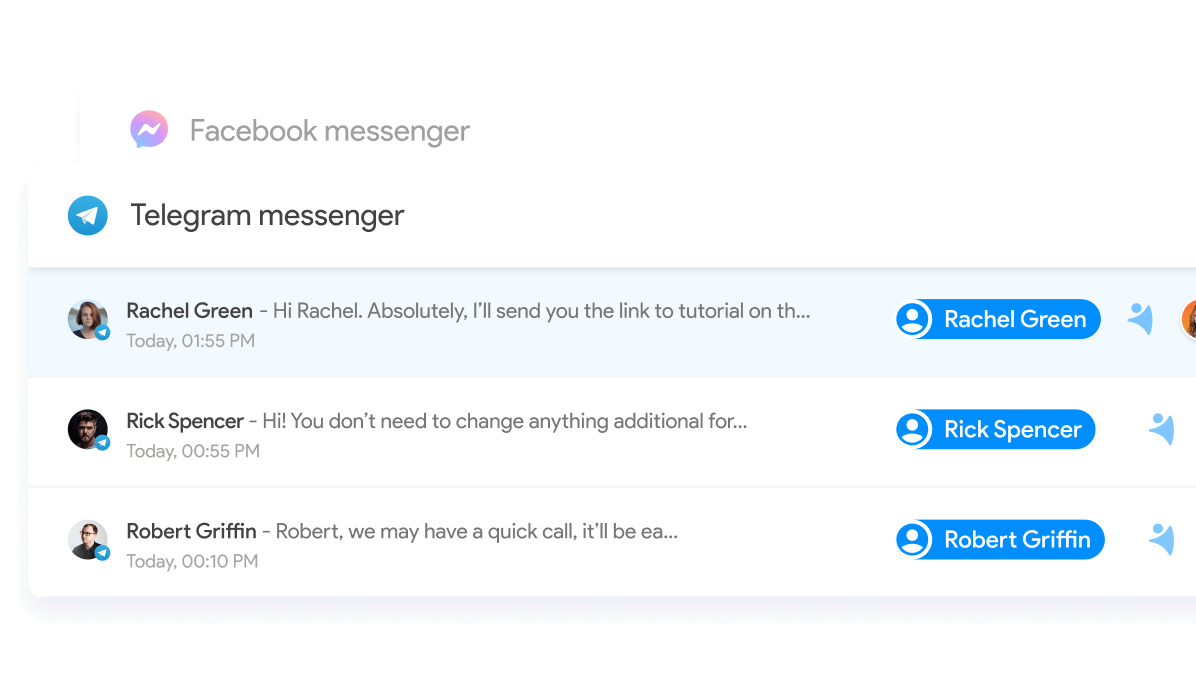

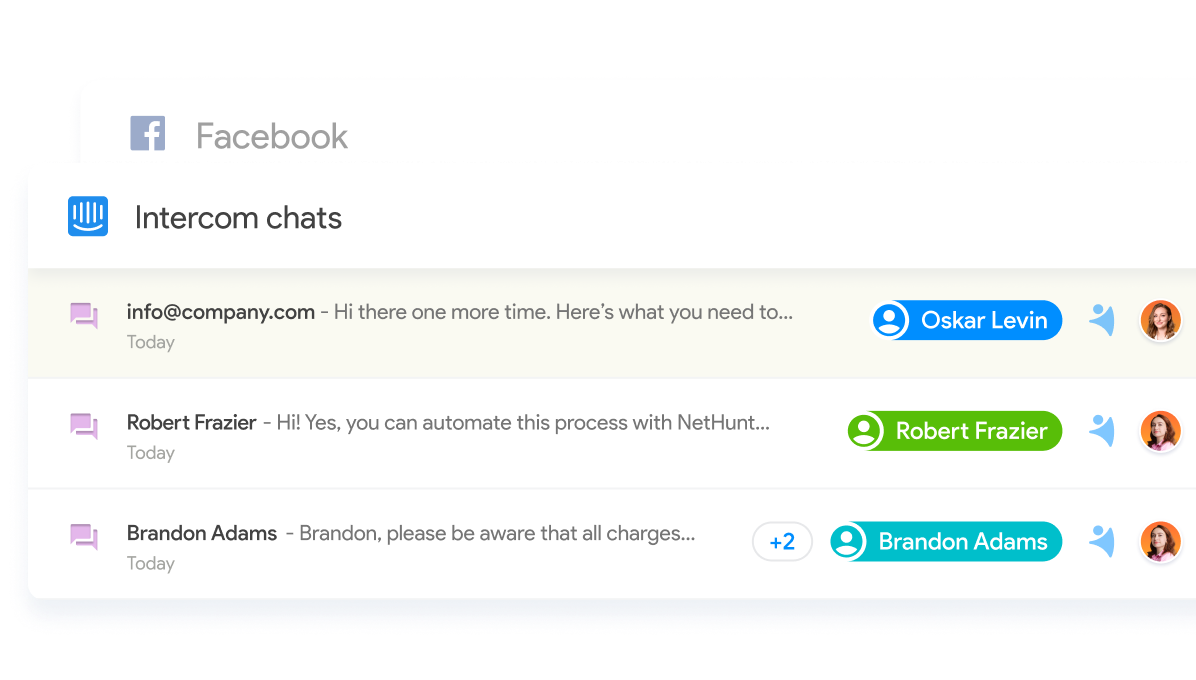

- capture leads from multiple channels;

- get enriched CRM profiles;

- nurture leads automatically for faster sales.

Manage all the deals from the centralized view

- sort deals by priority and chance to close;

- know exactly where the deals are stuck;

- feel confident about sales forecasts.

Track of all the sales activity within key metrics for your business

- identify the reasons of lost deals;

- track progress within certain period;

- get to know what your team is doing.

based on G2 customer reviews

based on G2 customer reviews